New opportunities in the InvestEU programme

The time has come, the EU budget for 2021-2027 has been approved after months of discussions. With it comes a whole new set of grants and funding opportunities! The EU is also making fresh money available for cash injections, loans and other strategic financial instruments. In this article, you will learn more about the new InvestEU financial programme and its funding opportunities.

What types of funding opportunities are there exactly?

The EU provides funding for projects in a variety of ways, mostly in the form of grants, loans, guarantees and prize money.

- Grants are the best known and most widely used funding in the EU. The EU provides financial assistance in the form of grants to organizations (and occasionally to individuals) to help them implement projects that are in the interest of EU policies. Such grants are awarded in a variety of areas ranging from research and education to humanitarian aid.

- Loans, guarantees and equity capital are the other important variety of grants through which the EU supports its policies and programmes. For example, the EU provides loans to companies of all types to invest not only in research and innovation, but also in other relevant areas. In addition, the EU provides guarantees so that recipients can obtain loans from banks and other lenders more easily or on better terms. It can also contribute to a project by providing equity capital.

Who awards the grants? Where and how can I apply for funding?

These funds are usually managed by financial institutions, such as banks, venture capitalists or business angels. These must apply to the EU and be approved through official accreditation. These local financial institutions decide on the allocation of EU funds and determine the exact funding conditions (amount, term, interest rate and fees).

Source: https://europa.eu/youreurope/business/finance-funding/getting-funding/access-finance/index_de.htm

Each EU member state has its own financial institutions that manage these funds. To provide a better overview of these opportunities, the EU has launched a portal called "Access to Finance". This portal offers help in applying for loans and venture capital provided with the support of the EU.

Who can apply for funding?

EU funding can be applied for by companies of any type, size or sector, i.e. young entrepreneurs, start-ups, micro-enterprises, small and medium-sized enterprises (SMEs) as well as larger companies. And this is where the "InvestEU" programme comes into play. The programme is the successor to the "European Fund for Strategic Investments (EFSI)", which was established in response to the financial crisis. InvestEU contains a total of three pillars:

- The InvestEU fund serves to mobilize public and private investments using guarantees from the EU budget.

- The InvestEU Advisory Platform provides technical advice on investment projects for which financing is needed.

- The InvestEU-PORTAL is an easily accessible database that brings together projects and investors.

What changes in the new funding period?

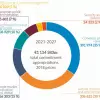

InvestEU relies on a guarantee of €26.2 billion from the new EU budget. Through this EU budget guarantee, the programme is designed to help increase the impact of public funds. The aim of the programme is to mobilize investments of around €370 billion from private and public institutions between 2021 and 2027 - for a social, sustainable and competitive EU.

Focus on key areas

The InvestEU Fund will support four policy areas in 2021-2027: sustainable infrastructure; research, innovation and digitalization; small and medium-sized enterprises; and social investment and skills.

- The policy area "Sustainable Infrastructure" supports financing of projects in the fields of sustainable energy, digital connectivity, transport, circular economy, water, waste and environment. à 8% of the budget (9.9 billion euros).

- Projects related to research and innovation, commercialization of research results, digitalization of industry, expansion of larger innovative companies, artificial intelligence are enabled in the area of "Research, innovation and digitalization". à 1% of the budget (6.6 billion euros).

- In the category "Small and Medium Enterprises", it is expected to facilitate access to financing for SMEs and small companies with medium market capitalization.

à 26.4% of the budget (6.9 billion euros).

- Projects on: Skills, Education and Training; Social Housing, Schools, Universities, Hospitals; Social Innovation, Health Care, Long-Term Care and Accessibility; Microfinance; Social Enterprises; Integration of Migrants, Refugees and Vulnerable Persons are expected to receive support in the area of "Social Investment and Skills". à 6% of the budget (2.8 billion euros)

Improving the investment environment in Europe.

Similar to the Juncker Plan, InvestEU will be part of the Commission's economic policy toolkit consisting of investments, structural reforms and responsible fiscal policy. This is to ensure that Europe remains an attractive place for companies to set up and operate successfully.

The European Investment Bank (EIB) remains the main partner for financing InvestEU programmes in the period 2021-2027. The EIB will implement 75 percent of the programme. The EU also aims to provide the necessary banking expertise to all partners involved in the implementation of the programme and to manage the risk for the entire programme.

The programme aims to bring together the multitude of financing instruments currently available under one roof and expand the successful model of the Juncker Plan.

In a nutshell ...

The European institutions have endowed InvestEU with numerous resources so that it can make a decisive contribution to creating new impetus for jobs, growth and investment. 14 financial instruments from the 2014-2020 funding period will be integrated into the new InvestEU. These are programmes such as COSME, the EU Program for the Competitiveness of Enterprises and SMEs, Connecting Europe Facility, “InnovFin - EU Funds for Innovation”, the “Private Finance Instrument for Energy Efficiency” or the “Easi-Investments for Capacity Building” and “Easi-Guarantees for Microfinance and Social Entrepreneurship”.